The corporate world has understood the overwhelming positive effect on the ease-of-doing-business and revenue due to Digital Transformation. When implemented right, technological advancements deliver higher returns than ever.As a strategic partner to the CEO and the rest of the C-suite, a CFO is at the forefront of strategic options that not only mitigate risks but enable the enterprise to thrive.But, if the CFO watches the CEOs back, who watches the CFO’s back?The answer is Digital Transformation! Simply put, it means implementing Technology Solution to manage operations. For instance, implementing a comprehensive interconnected Enterprise Resource Planning system. ERP solutions ensure that financial planning, reporting and operations management are inter-connected, governed and visible. Identifying trends and anticipating change in trends to make short term budget adjustments and long-term capital expenditure planning for superior ROIFinding it difficult to navigate through data due to disconnected systems using multiple software that operate in data silosFor example, you might have a system that uses a spreadsheet program to generate invoices, but the data for those invoices come from a database program that contains customer information.The inventory system then uses a separate system that stores the individual data so we must verify any data in it before we can consider it correct to fulfil orders. It is unnecessarily difficult and inconvenient for any business.And this is just one example of business going wrong due to disconnected systems.

Identifying trends and anticipating change in trends to make short term budget adjustments and long-term capital expenditure planning for superior ROIFinding it difficult to navigate through data due to disconnected systems using multiple software that operate in data silosFor example, you might have a system that uses a spreadsheet program to generate invoices, but the data for those invoices come from a database program that contains customer information.The inventory system then uses a separate system that stores the individual data so we must verify any data in it before we can consider it correct to fulfil orders. It is unnecessarily difficult and inconvenient for any business.And this is just one example of business going wrong due to disconnected systems.

The CFOs checklist before considering Digital Transformation

If you tick most of these questions positively, it’s high time you get started on your Digital Transformation journey.- How do you get a single view of your financial information?

- Do you lack visibility into day-to-day business operations?

- Are your current business processes redundant and inefficient?

- Is your team over-burdened with execution leaving little time to strategic implementation?

- How easy is it for your employees to keep timesheets and personal information?

- Can you see the status of your cash in real-time?

- Is your business growing fast but outdated software is lagging?

- Tired of using multiple systems to integrate the business?

- Do you need a platform to quickly get reliable information about every business?

- Can’t access real-time information on-the-go with your current software?

- Is your business quickly expanding regionally and/or worldwide and do you need an integrated location solution?

- Looking for reliable technology solutions like ERP to help you make immediate decisions?

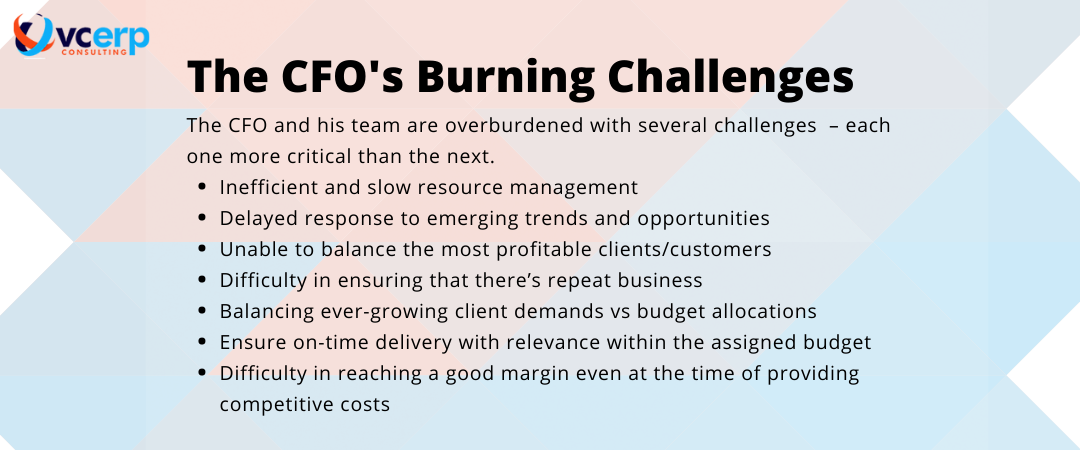

Understanding operational challenges the CFO faces

It’s not always a One-Man-Job!!!

As the CFO seeks to plan and implement a viable business transformation strategy, a cross-functional collaborative team is needed. The Finance and Accounting department focuses on solving business problems, not just cost reduction and optimization.This team should ideally combine multiple skills including analytics, automation, data visualization and process expertise.How to harness data that’s already available?!

Besides traditional financial skills, the CFO must now combine the skills of a data scientist. The problem now is no longer about collecting data, but what to do with the vast amount of information that comes into the business around the clock, seven days a week.This is where embedded analytics that give real time insights on your daily transactions in ERP solutions like SAP Business One, SAP Business ByDesign or SAP S/4HANA come into picture.Some common operational issues faced by the Accounts and Finance team include:

Creating and implementing data protection regulations to protect data from infection and theft is now the direct responsibility of CFOs to preserve the digital trust of customers & investors. Identifying trends and anticipating change in trends to make short term budget adjustments and long-term capital expenditure planning for superior ROIFinding it difficult to navigate through data due to disconnected systems using multiple software that operate in data silosFor example, you might have a system that uses a spreadsheet program to generate invoices, but the data for those invoices come from a database program that contains customer information.The inventory system then uses a separate system that stores the individual data so we must verify any data in it before we can consider it correct to fulfil orders. It is unnecessarily difficult and inconvenient for any business.And this is just one example of business going wrong due to disconnected systems.

Identifying trends and anticipating change in trends to make short term budget adjustments and long-term capital expenditure planning for superior ROIFinding it difficult to navigate through data due to disconnected systems using multiple software that operate in data silosFor example, you might have a system that uses a spreadsheet program to generate invoices, but the data for those invoices come from a database program that contains customer information.The inventory system then uses a separate system that stores the individual data so we must verify any data in it before we can consider it correct to fulfil orders. It is unnecessarily difficult and inconvenient for any business.And this is just one example of business going wrong due to disconnected systems.How the ERP system solves the CFOs burning challenges

CFOs want reliable solutions and efficient execution, not sumptuous strategies.

The CFO wants a reliable solution that the staff can readily use without hassles. It has to be reliable, efficient and of course must promise a high ROI. It must be something that goes beyond promising strategies to translating actual strategies into day-to-day execution – where the team reaches their goals methodically daily as part of the existing processes.Sounds like a fantasy?

However, an ERP Solution like SAP Business One or SAP Business ByDesign does hold true to these conditions and promises much more. When implemented by the right implementation partner, it can do wonders for the way you do business.Since the late 1990s, enterprise resource planning (ERP) vendors, analysts and CIOs have advocated the use of a single ERP system as a solution to data integration and reporting challenges.“A global survey revealed by Rimini Street, Inc, a global & leading third-party support provider for Oracle and SAP products, conducted among over 1500 CFOs and financial leaders across 13 markets covering major industries.”This survey stated that in terms of digital transformation and its importance in other corporate priorities,

- 80% of global CFOs believe it is in the top 5 of their priority list

- 71% of surveyed CFOs believe that investing in digital transformation is the success of their company

- 77% of respondents said that if the program can bring a high ROI they will help CIOs fund new digital transformation projects