This article serves as a guide to E-Invoice generation for B2B GST tax compliance in India for businesses with an annual turnover of Rs. 100 crore and above.

E-Invoice under GST (Goods and Services Tax) is the now mandated system where all B2B invoices are declared authentic by the GST Network for future use once they are submitted on the Invoice Registration Portal (IRP).

Each E-Invoice is declared authentic only if it has received the IRN, Invoice Reference Number. Such electronically authenticated B2B invoices will then be shared with the GST system by the IRP for further tax compliance purposes.

In this E-Invoice guide, we walk you through every step of the way for creating an E-Invoice for your organization using VC ERP’s E-Invoice Solution for SAP Business One.

Latest GST Council Update on E-Invoice

8th March 2021

E-invoicing will be applicable from 1st April 2021 for businesses with a turnover of more than INR 50 crores (in any financial year from FY 2017-18 onwards).10th November 2020

As of 10th November 2020 update, E-invoicing on the IRP portal is now mandatory for companies over INR 100 crore revenue from January 1, 2021 onwards for each sale they make.The implementation of E-Invoice will help reduce the tax evasion, track fake invoices and offer a common platform to the tax authorities to assess GST data.

Here, we attempt to address all possible questions fluttering through the minds of confused taxpayers across India.

Can I generate the E-Invoice directly from my SAP Business One?

Yes. Direct Integration of E-Invoice for GST is possible for Accounting and Billing systems or for ERP systems like SAP Business One.

As the E-Invoice, the tax invoice for GST, has a separate Invoice Registration Portal, all Businesses can through direct integration, directly generate E-Invoice from their ERP.

You can reach out to VC ERP to integrate this solution in your SAP Business One or other SAP ERP systems like SAP S/4HANA or SAP ECC.

At VC ERP, we have created Add-Ons compatible with SAP solutions including SAP Business One. This feature when activated in your system, helps you create authentic E-Invoice with unique IRN and QR code for each transaction without manually logging in to the IRP website each time.

How can I generate E-Invoice directly from my SAP Business One system?

The process of creating E-Invoice on SAP using VC ERP’s E-Invoice is simple:

- Activate the Solution in your SAP Business One. Once the capability is activated

- Fill out the AR Invoice or Sales Invoice as you usually do.

- After you fill out the details, the QR code will be automatically generated by the system as it is communicating with the GST IRP portal directly from your system. Since the exchange happens through a registered GSP, there is no need for Whitelisting IPs. What this means is once you have the integration implemented, you’re good to go.

- After you have added the entry, you select the GST specified Batch Number from the pop-up, it will ask you to add the Sales Invoice, as once these details are entered they cannot be edited. Once this is done, a pop-up will flash on the screen asking you for making the GST compliant E-Invoice for this transaction.

- Once you select “Yes” the Sales Invoice will become a GST compliant E-Invoice as data is exchanged between your system and the IRP through the whitelisted GSP gateway working at the backend.

- You can then search for this particular AR Invoice in your system

- Once you click on the corresponding record, you will find the E-Invoice for the Sales Invoice with the GST verified IRN number and the QR Code.

- You can then print this E-Invoice based on the GSTN specified schema by selecting from a list of pre-configured and customized, Print Ready layouts for your organization. Select the Sales-E-Invoice layout option from the Choose Layout pop-up.

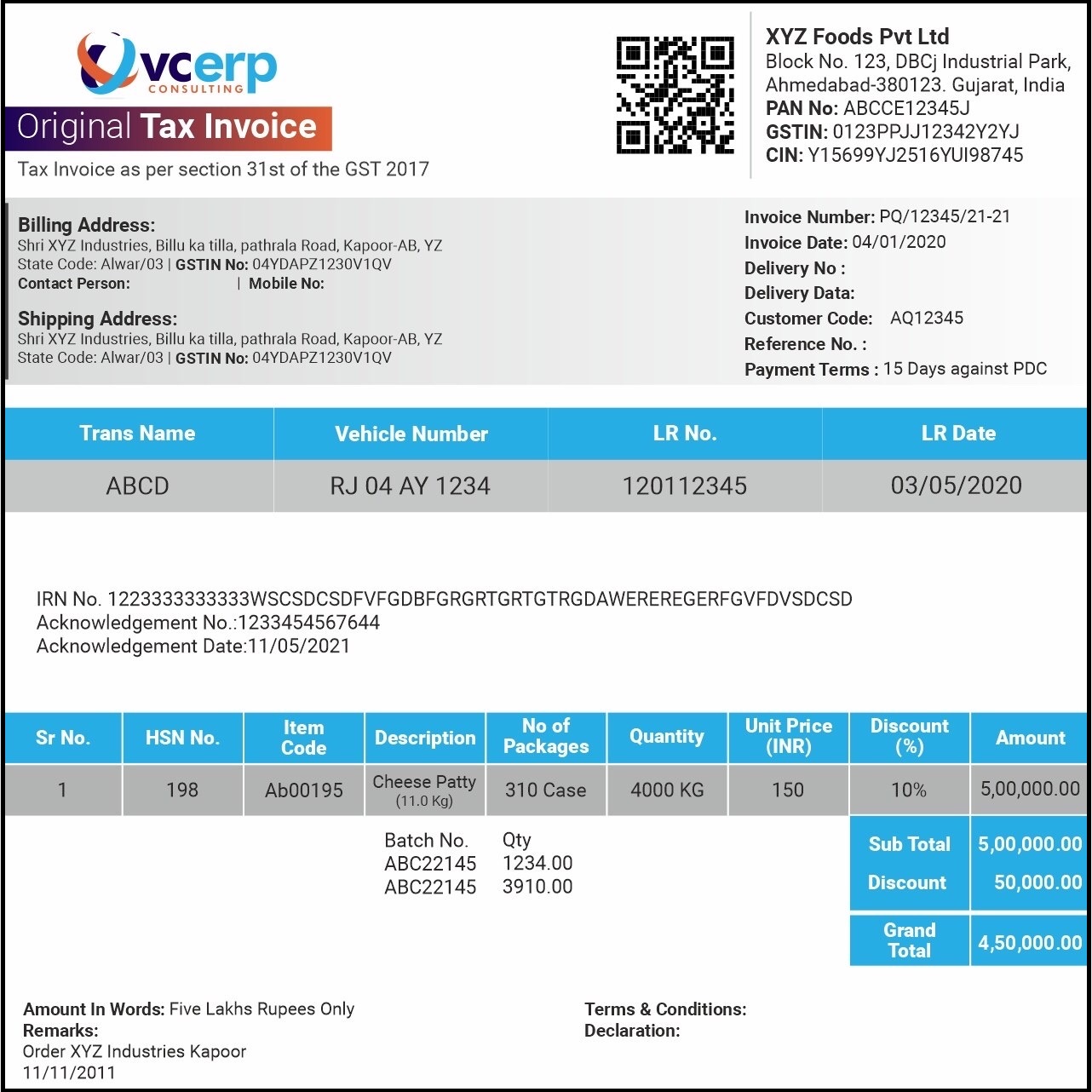

The final machine-readable GST E-Invoice will look like this

Now, thanks to the E-Invoice solution from VC ERP Consulting Pvt Ltd., the E-Invoice can be quickly generated, while IRN number with QR code can be received in real-time. This is more secure than a regular API integration and hassle-free.

All invoice information will be transferred from this portal to both the GST portal and e-way bill portal in real-time. Therefore, it will eliminate the need for manual data entry while filing GSTR-1 return as well as generation of part-A of the e-way bills, as the information is passed directly by the IRP to GST portal.

The turn-around time is also just a few days.

Sounds unbelievable? Then, catch the demo live in action. Speak to our expert Consultants today. Get in touch with award winning SAP for SME consultants and advisors at VC ERP Consulting for free consultation. Call +91 79 48998911 (India) Whatsapp +254 111229970 (Kenya), Call +1 469 915 6026 (North America) or drop an email at sayhello@vc-erp.com