With the emergence and the wide adoption of everything from online payments to artificial intelligence and automation in businesses, people’s perceptions towards using technology and their methods of work are rapidly changing in countless ways.

In fact, over the past few years, the role of the CFOs has also gone through its own evolution.

It now has evolved much beyond financial decision-making encompassing planning, detailing steps-to-action, crisis management and of course navigating volatility and disruption.

Undoubtedly, CFOs are ready with their hands on the wheel, helping drive stability across businesses.

They are reshaping the company’s agenda, engaging with investors and capital markets, ensuring strong financial performance and partnering with business colleagues to support operations.

Change often comes at the cost of an impact on business bottom line and unexpected expenses which keeps finance leaders up all night.

In this article, experts at VC ERP Consulting highlight the top 3 burning challenges that CFOs will face in 2023 and the best ways to combat them by tools and techniques that actually help them embrace change.

The role of the CFO has evolved to a technology evangelist – the one who knows the impact of data-based insights can have on enterprise strategy and growth. CFOs are on the path to adopt Enterprise Resource Planning solutions that help you counter the burning business challenges.

Below are the top 3 global burning challenges for CFOs in 2023:

CFOs are juggling between pivoting to digital innovation, workforce transformation and financial consolidation. With the changing times, a change is also expected in security and compliance.

As a CFO, quickly adapting to these major changes is not enough. Stakeholders expect that you must foresee the new path, assess all identified and unidentified risks and implement a strategy accordingly.

Adopt digital transformation by choosing the right technology allowing you to efficiently adapt and offer the best protection against fraud while mitigating other risks and ensuring compliance.

Implement SAP Business One that offers real-time information and allows you to reinvent business and billing models in an instant making your business ready to scale.

This comprehensive business management solution has total control and risk management built right in that helps you take on all the challenges that come with growth.

The bigger challenge is that now in order to meet different needs, companies have invested in multiple solutions to take advantage of every service. This also means that your critical business is scattered all over the place.

Take control of your critical business data and put all your work in SAP Business One, a unified business management solution for fast and accurate retrieval, reporting and communication of data across departments.

SAP Business One seamlessly integrates with your business processes and enables effortless transfer of information across all departments. This affordable solution ensures that you can easily optimize your business costs, without even reinventing the wheel by finding relevant SAP Business One add-ons that creates the flow of data as per your unique business needs.

SAP Business One ERP Solution helps record transactions that are reflected automatically across all ledgers for faster management and a single source of truth that includes all financial data.

Automate financial business processes and define closing tasks in advance to minimize the risk of data omission. Generate transparent audit trail to automate financial value chain operations such as payment reminders, payment advice, electronic bank transfers and bank statements.

Sail through this challenge, while making sure that all the efforts are aligning in the same direction.

Achieve total success by having a well-oiled machine with a well-functioning SAP Business One that offers accurate and up-to-date business data to advocate for decisions and actions.

A recent IDC Analyst Connection outlines in a series of questions and answers that digital resiliency begins in the office of CFO. In the changing world, CFOs want ownership of the technologies that enable them to do their jobs without being dependent on IT for access and enablement.

In addition, the high volume of interconnected transactions also demand greater control, visibility and monitoring from the CFO’s office. As data becomes more valuable and critical, finance too can leverage greater control by harnessing it. And, this is what drives towards generating more revenue streams.

Get it right with the help of SAP Business One.

With SAP Business One, implemented by VC ERP Consulting, you can –

Get in touch with award winning SAP Gold Partner, Certified Expert SAP Business One Consultants and Advisors at VC ERP Consulting for free consultation.

Call +91 7948998911 (India), Whatsapp +254 111229970 (Kenya), Call +1 469 9156026 (North America), +974 31239246 (MENA) or drop an E-mail at sayhello@vc-erp.com.

In fact, over the past few years, the role of the CFOs has also gone through its own evolution.

It now has evolved much beyond financial decision-making encompassing planning, detailing steps-to-action, crisis management and of course navigating volatility and disruption.

Undoubtedly, CFOs are ready with their hands on the wheel, helping drive stability across businesses.

They are reshaping the company’s agenda, engaging with investors and capital markets, ensuring strong financial performance and partnering with business colleagues to support operations.

Change often comes at the cost of an impact on business bottom line and unexpected expenses which keeps finance leaders up all night.

In this article, experts at VC ERP Consulting highlight the top 3 burning challenges that CFOs will face in 2023 and the best ways to combat them by tools and techniques that actually help them embrace change.

Top 3 Challenges Faced by CFOs in 2023 & How SAP Business One Solves them

The role of the CFO has evolved to a technology evangelist – the one who knows the impact of data-based insights can have on enterprise strategy and growth. CFOs are on the path to adopt Enterprise Resource Planning solutions that help you counter the burning business challenges.

Below are the top 3 global burning challenges for CFOs in 2023:

1. Adjusting to the reality of Digital Transformation

Every industry is changing and traditional methods are becoming obsolete giving rise to digital transformation which brings new obstacles and opportunities.CFOs are juggling between pivoting to digital innovation, workforce transformation and financial consolidation. With the changing times, a change is also expected in security and compliance.

As a CFO, quickly adapting to these major changes is not enough. Stakeholders expect that you must foresee the new path, assess all identified and unidentified risks and implement a strategy accordingly.

How to combat this burning business challenge?

Identify the right technology for your business environmentAdopt digital transformation by choosing the right technology allowing you to efficiently adapt and offer the best protection against fraud while mitigating other risks and ensuring compliance.

Implement SAP Business One that offers real-time information and allows you to reinvent business and billing models in an instant making your business ready to scale.

This comprehensive business management solution has total control and risk management built right in that helps you take on all the challenges that come with growth.

2. Fragmented business processes & disparate data

The burning challenge of adopting digital transformation has created an abundance of disparate systems that assist in enhancing the CFO role, however, this has also opened the job up to further issues.The bigger challenge is that now in order to meet different needs, companies have invested in multiple solutions to take advantage of every service. This also means that your critical business is scattered all over the place.

How to combat this burning business challenge?

Invest in a unified business management solutionTake control of your critical business data and put all your work in SAP Business One, a unified business management solution for fast and accurate retrieval, reporting and communication of data across departments.

SAP Business One seamlessly integrates with your business processes and enables effortless transfer of information across all departments. This affordable solution ensures that you can easily optimize your business costs, without even reinventing the wheel by finding relevant SAP Business One add-ons that creates the flow of data as per your unique business needs.

3. Traditional Financial Challenges

Financial reporting with accurate and auditable data, cash flow management, adhering to taxes and regulations, optimizing costs and increasing revenue streams are age-old issues faced by CFOs and remain a top priority. Global downturns and market volatility are at the front of these challenges. These uncertain areas cause constant ups and downs when it comes to pricing and taxes. The pandemic and other global conflicts play a big part in the current challenge as they present more uncertainty for current and future situations.How can the CFO combat burning financial challenges in an SMB?

Run highly efficient and automated financial processesSAP Business One ERP Solution helps record transactions that are reflected automatically across all ledgers for faster management and a single source of truth that includes all financial data.

Automate financial business processes and define closing tasks in advance to minimize the risk of data omission. Generate transparent audit trail to automate financial value chain operations such as payment reminders, payment advice, electronic bank transfers and bank statements.

Sail through this challenge, while making sure that all the efforts are aligning in the same direction.

Achieve total success by having a well-oiled machine with a well-functioning SAP Business One that offers accurate and up-to-date business data to advocate for decisions and actions.

Reap the Rewards of Resiliency with SAP Business One Today!

A recent IDC Analyst Connection outlines in a series of questions and answers that digital resiliency begins in the office of CFO. In the changing world, CFOs want ownership of the technologies that enable them to do their jobs without being dependent on IT for access and enablement.

In addition, the high volume of interconnected transactions also demand greater control, visibility and monitoring from the CFO’s office. As data becomes more valuable and critical, finance too can leverage greater control by harnessing it. And, this is what drives towards generating more revenue streams.

Get it right with the help of SAP Business One.

With SAP Business One, implemented by VC ERP Consulting, you can –

- Implement Automated Internal Controls

- Localization and Strict Adherence to Industry Regulations

- Business Practice Customization

- Periodic Automated Financial Reconciliation

- Make Your Business More Resilient

- Connect different parts of your business

- Highlight opportunities you may not have forecasted

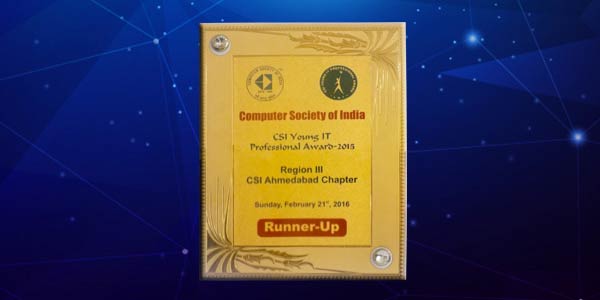

Get in touch with award winning SAP Gold Partner, Certified Expert SAP Business One Consultants and Advisors at VC ERP Consulting for free consultation.

Call +91 7948998911 (India), Whatsapp +254 111229970 (Kenya), Call +1 469 9156026 (North America), +974 31239246 (MENA) or drop an E-mail at sayhello@vc-erp.com.