Traditional asset accounting methods, while functional, often come with limitations that hinder businesses from fully leveraging their assets’ potential. These limitations include:

- Inability to capture Intangible Assets

- Lack of detailed information

- Limited adaptability to changing business environments

- Difficulty in assessing digital companies

- Incomplete cost knowledge

And the list goes on…

The introduction of the New Asset Accounting (new AA) submodule in SAP S/4HANA Finance not only provides a breath of fresh air to resolving these speed breakers but also represents a significant leap into enterprise resource planning (ERP).

You may be wondering why it is called “new”. This is because the new Asset Accounting in SAP S/4HANA differs from the old version. How?

- Real-time integration with the general ledger ensures immediate transfer of asset postings without the need for periodic posting programs

- Integrates all financial data into a single table that simplifies financial and controlling field management

- Companies can set up multiple depreciation areas to handle various valuation principles which ultimately enhances flexibility in asset valuation

This article enriched with the knowledge and ground-level practical understanding of VC ERP Consulting’s experts will provide deeper insights into the aforementioned New Asset Accounting features in SAP S/4HANA ERP.

Features and Functionalities of New Asset Accounting in SAP S/4HANA

Fixed assets, also known as property, plant and equipment (PP&E) form the foundation for many companies’ operations. It represents a pronounced portion of the balance sheet especially in capital-intensive industries like utilities, construction and telecoms.

These industries rely heavily on physical infrastructure, equipment and machinery. Thus, there is no room for any errors or inconsistencies in fixed asset records which can have a material impact on the company’s financial statements.

We understand that companies are obligated to adhere to accounting standards when reporting fixed assets. These standards such as IFRS or US GAAP dictate the appropriate valuation methods, depreciation calculations and disclosure requirements for fixed assets. So it means that improper fixed asset accounting can lead to non-compliance issues.

These are certain criteria of problems that are well-thought-out and reduced to negligible when it comes to SAP S/4HANA’s capabilities related to new asset accounting (NAA). Here’s a closer look at some of the key functionalities:

Parallel Valuation Methods

SAP S/4HANA has made asset accounting easy for multinational companies with operations in countries that have different accounting standards. Parallel valuation allows MNCs to manage assets according to different accounting principles (e.g., IFRS, GAAP) using separate ledgers or accounts.

New Asset Accounting within SAP S/4HANA supports up to three valuation approaches in parallel viz., legal valuation view, group valuation view and profit centre valuation view. Each view provides a distinct perspective on asset valuation which means it caters to different reporting needs within the organization.

This feature allows companies to handle multiple accounting principles efficiently and ensure accurate reporting across various standards without the need for complex workarounds. So, it is also beneficial to the companies with subsidiaries that operate under local GAAP for tax purposes but need to consolidate their financials under IFRS for reporting to investors.

Experts at VC ERP Consulting are here to explain the two primary approaches to managing parallel valuations for assets:

Ledger Approach for Parallel Valuation in New Asset Accounting

The ledger approach is a method in SAP S/4HANA for managing asset values under different accounting principles simultaneously. This is particularly useful when you need your financial statements to comply with various accounting standards.

Benefits of the Ledger Approach:

- You only need one set of accounts in your chart of accounts regardless of the number of accounting principles you use.

- You can generate financial statements for each accounting principle from the same set of data and thus eliminate the need for separate versions.

- The system automatically posts transactions to the appropriate depreciation area based on the assigned ledger group.

Account Approach for Parallel Valuation in New Asset Accounting

The Account Approach is another method in SAP S/4HANA Asset Accounting for handling parallel asset valuations where you manage separate values for the same asset under different accounting principles. It works differently from the Ledger Approach we discussed earlier.

This approach relies on the traditional chart of accounts and creates separate accounts within the chart of accounts for each accounting principle used (e.g., German GAAP and US GAAP accounts).

While there is a clear advantage of this approach, i.e. a clear distinction between asset values for different accounting principles within the chart of accounts; it comes with drawbacks like:

- Increased account complexity (duplicate accounts for different principles)

- Higher error risk (manual selection of accounting principles for transactions)

- Reporting challenges (may require additional processing for separate statements)

Are you thinking about what could be the right approach for your corporation? The best approach for your organization depends on your specific needs and priorities.

For this, your organization requires the help of the best SAP implementation partner VC ERP Consulting to evaluate your specific requirements and support your company in exploiting this feature in SAP S/4HANA Asset Accounting to the maximum.

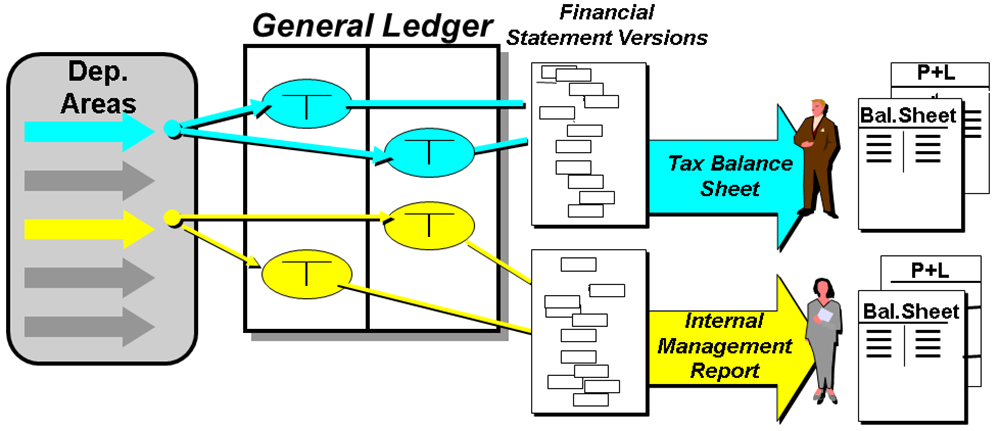

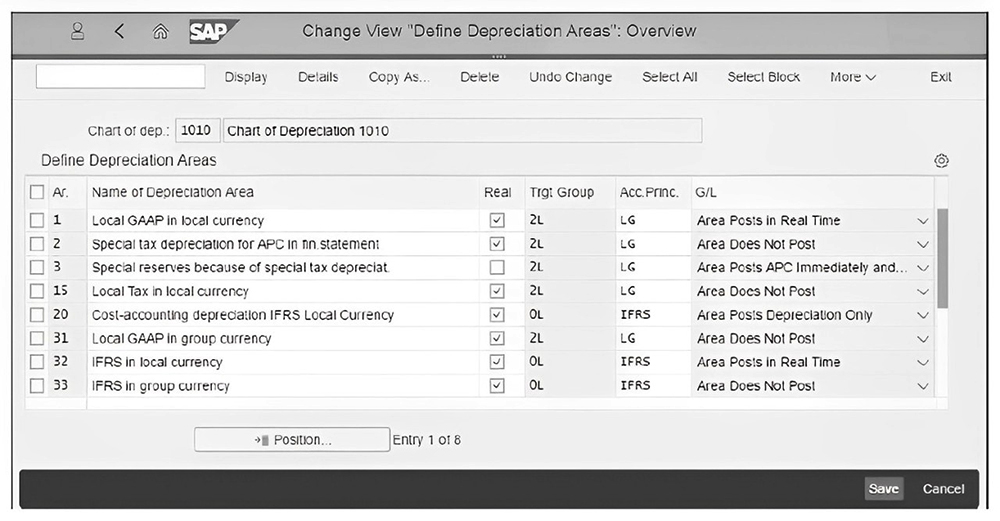

Statutory and Management Depreciation Areas

New Asset Accounting in SAP S/4HANA allows for the creation of both statutory and management depreciation areas. This feature enables the organizations to comply with legal requirements while also providing insights for internal management purposes.

You might wonder what is a depreciation area.

Depreciation areas in SAP S/4HANA Asset Accounting are separate compartments for calculating an asset’s value. Each compartment caters to a specific need. So you might need one value for your financial statements (balance sheet) and another for internal cost calculations.

With up to 99 areas under Asset Accounting Customizing, companies can manage a wide range of valuations for their assets. These areas are grouped together based on specific country or economic requirements which ultimately form a chart of depreciation.

Statutory Depreciation

Organizations are required to report their assets using these standards to comply with legal and regulatory requirements.

Management Depreciation

Management depreciation areas can be tailored to the specific needs of the organization by SAP implementation partners like VC ERP Consulting as it allows for more granular and customized reporting.

It doesn’t end here though. Companies can easily assign different depreciation areas to different accounting principles to make the process of asset valuation flexible.

So let’s say your company owns various types of equipment each with a different useful life.

Using flexible mapping, they can assign a specific depreciation area with the appropriate calculation method to each equipment type (e.g., accelerated depreciation for heavy machinery, straight-line depreciation for office furniture).

Read more: How SAP S/4HANA Finance Makes Real Time Financial Close PossibleReal Time Postings for Multiple Ledgers

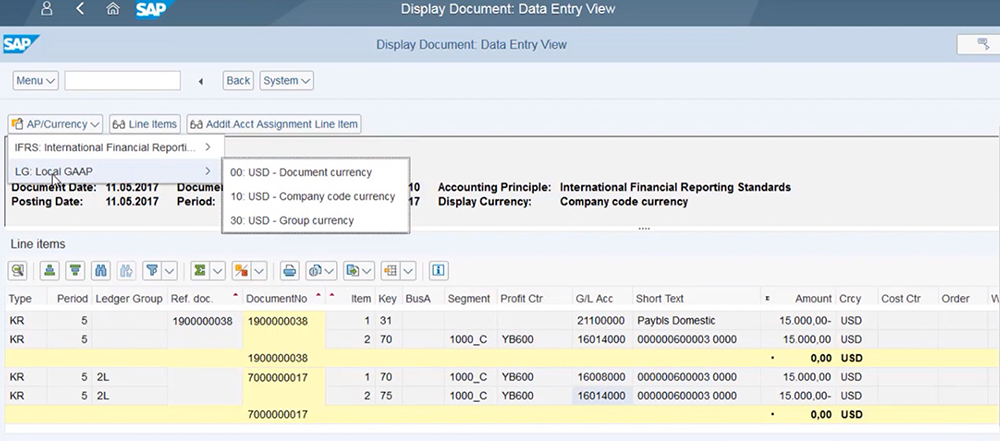

Prior to SAP S/4HANA Asset Accounting (New) managing assets under different accounting principles involved complex reconciliations to ensure all ledgers reflected the same values. NAA eliminates this issue by enabling real-time postings to all relevant ledgers simultaneously.

SAP S/4HANA with New Asset Accounting allows companies to maintain two or more sets of books simultaneously for different accounting principles. The system supports up to 10 currencies for asset accounting.

Companies can configure multiple ledgers within S/4HANA’s general ledger to segregate financial data based on accounting principles or other criteria.

With NAA, when a depreciation expense is calculated for an asset the system automatically posts that expense to all relevant ledgers (based on the pre-defined configuration in the depreciation area) in real-time.

This means that any transaction involving fixed assets is instantly reflected in the financial records without the need for manual or delayed postings.

Asset Under Construction (AuC) Management

For the uninitiated, an Asset Under Construction (AUC) is a special type of tangible asset that is usually displayed as a separate balance sheet item because of its temporary nature until it is fully constructed to be put to use. It requires its own asset classes and separate account determination.

Improved management of Assets under Construction allows for better tracking and capitalization of construction-in-progress projects. SAP S/4HANA streamlines this process from acquisition to asset capitalization.

- New Asset Accounting provides improved tools for tracking assets under construction so that organizations can monitor the progress of construction projects and ensure that assets are properly capitalized.

- New Asset Accounting provides the assurance that AuCs are properly capitalized and reported per relevant accounting standards.

SAP S/4HANA provides a comprehensive set of tools and transactions for managing asset acquisition, retirement, transfer and scrapping.

Asset Acquisition, Retirement, Transfer & Scrapping

Asset acquisitions can be posted directly from the Financial Accounting module (FI) to the Asset Accounting module and so this offsets the need for manual reconciliation between FI and Asset Accounting (AA).

Asset retirement is handled through various processes and transactions:

- SAP S/4HANA supports retirement with revenue but without a customer (not integrated) as one of the options for asset retirement by scrapping. It allows companies to retire assets that are still contributing to revenue generation even though they are being removed from the active asset pool.

- Another option available in SAP S/4HANA is retirement without revenue (aka asset retirement by scrapping) which is typically used when an asset is no longer functional or has reached the end of its useful life.

- The S/4HANA system also allows for proportional value adjustments during the asset retirement process which basically helps adjust the value of an asset based on its remaining useful life.

Now in relation to asset transfers there are two main types in SAP S/4HANA for fixed assets:

Intracompany Asset Transfer which occurs within a single company code. So as an example, the asset is essentially being moved from one department to another within the same legal entity.

Intercompany Asset Transfer which happens between different company codes within the same SAP system (corporate group). For instance, include assets being transferred from one company to another with different ownership structures or reporting requirements.

Key differences between these above two transfers:

| Feature | Intracompany Transfer | Intercompany Transfer |

| Company Codes | Same company code | Different company codes (within the same SAP system) |

| Transaction Type | Specific for intracompany transfers | Specific for intercompany transfers (automatic or manual) |

| Retirement and Acquisition | Treated as a single internal movement | Treated as a retirement in the sending company and an acquisition in the receiving company |

| Reporting Impact | Affects internal departmental or location balances | Affects separate company financial statements |

Automated Depreciation Runs

SAP S/4HANA provides the ability to execute depreciation runs automatically. The system can be configured to perform depreciation runs on a regular basis and not only does this ensure that depreciation is calculated and posted accurately but it also saves time and reduce the risk of human errors

Thus for organizations with a large number of fixed assets SAP S/4HANA for asset accounting allows for efficient and consistent depreciation management.

India Income Tax Depreciation in SAP S/4HANA

In SAP S/4HANA tax depreciation for assets located in India is calculated based on specific tax laws and regulations.

When creating fixed assets in SAP S/4HANA for assets located in India, default values from the asset class are used for calculating income tax depreciation. SAP S/4HANA allows for country-specific configurations to accommodate the unique requirements of income tax depreciation in India.

Bringing it all home, VC ERP have thoroughly explained how these features help companies manage their fixed assets in compliance with accounting standards and tax regulations.

Read more: How Does SAP S/4HANA India Localisation Help in Tax Compliances?

Understanding Asset Master Data Configuration in SAP S/4HANA

While exploring the new Asset Accounting module in SAP S/4HANA, you might encounter terms like “asset class” and “account determination.” But what exactly do they mean?

An asset class in SAP S/4HANA groups assets with similar characteristics so that there are common rules and settings for depreciation calculation, valuation methods, account determination and useful life.

An account determination in SAP S/4HANA specifies the general ledger accounts hit to record transactions related to a specific asset class. So there will be separate accounts for acquisitions, depreciation expense, accumulated depreciation and disposals.

So the process flow goes like this:

- You establish a chart of depreciation in your system. This lays the foundation for the account determination process wherein it acts as a master list containing all the general ledger accounts used for depreciation calculations.

Then, you define asset classes in SAP S/4HANA wherein you link them to a pre-defined account determination key.

You configure account determination keys. The key essentially defines which accounts from the chart of depreciation will be used for acquisitions, depreciation expense and such other various transactions related to a specific asset class.

You start creating individual asset records in a new asset master record in SAP S/4HANA and assign it to a specific asset class based on its characteristics. And as discussed earlier, this asset class references a pre-defined account determination key.

Whenever you post transactions for the asset related to acquisition, depreciation or disposal the system automatically uses the designated general ledger accounts based on the account determination key linked to the asset’s class. This key retrieves the relevant depreciation accounts from the chart of depreciation.

VC ERP Consulting understands that it can be difficult for the whole organisation to tackle the intricacies of a new system. That’s why we believe in knowledge-based partnerships. Here’s how understanding asset master data configuration benefits you:

- See for yourself how every asset transaction impacts your financial statements so that you can monitor asset lifecycles, identify potential accounting issues and ensure compliance.

- Knowing how asset classes and account determination work allows you to make strategic choices about asset purchases, depreciation methods and disposal strategies.

- It saves your organization a lot of time when the best SAP S/4Hanaimplementation partner like VC ERP provides a well-configured account determination process that automates account selection.

VC ERP Consulting: Your SAP S/4HANA Asset Management Experts

At VC ERP Consulting, our team possesses in-depth knowledge of SAP S/4HANA’s asset management functionalities. We can help you:

- Define optimal asset classes that accurately reflect your company’s asset portfolio.

- Configure account determination rules to ensure consistent and compliant accounting practices.

- Integrate the new Asset Accounting module seamlessly with your existing financial processes.

Partnering with VC ERP Consulting goes beyond just being a technology implementation partner. We become your trusted advisor to exploit and enjoy the full potential of SAP S/4HANA for efficient and insightful asset management.

Contact us today to schedule a free consultation and explore how we can optimize your asset accounting in SAP S/4HANA.