Managing finances can feel like running a business blindfolded in a whirlwind. Real-time financial insights are crucial for faster, more effective decision-making. The modern business world throws everything at you – from unpredictable markets to currency fluctuations. And so, the cornerstone of any organization’s financial health lies in its treasury and risk management (TRM) practices, alongside strong cash and liquidity management.

Effective management of cash flow, investments, and financial risks like hedging and exposure is crucial for short-term stability, sound financial choices, and ultimately, sustainable growth.

SAP Treasury and Risk Management (TRM) in SAP S/4HANA is here to be your trusty six-shooter. It’s like a central hub for your financial rodeo helping you manage everything from cash flow, insights into cash positions, allocate funds across strategic areas and divisions to investments.

Why SAP S/4HANA Treasury? As market complexities increase, the need for a consolidated treasury system becomes imperative. From handling commodity trading to navigating foreign exchange volatility and evolving regulations, the pressures on CFOs are mounting.

Key functionalities of SAP S/4HANA TRM include managing money market transactions, foreign exchange transactions, loans, derivatives, securities, commodities, and trade finance.

In this article, we’ll discuss these key features and more and explore its comprehensive suite of tools designed to empower organizations with efficient financial management, risk mitigation, and insightful decision-making.

Why Is Treasury and Risk Management Important?

The financial well-being of any organization hinges on its ability to manage its cash flow, investments, and financial risks effectively. This is where treasury and risk management (TRM) comes into play. TRM acts as the captain navigating the complex financial landscape, ensuring smooth sailing and protecting against potential storms.

The key functionalities of Treasury and Risk Management include:

Deal and Instrument Management

Capturing deals and instruments for position management is essential for effective treasury operations.

Risk and Exposure Management

Managing risks and exposures is crucial for maintaining financial stability and protecting against market volatility.

Accounting Processes

Executing accounting processes for settlement, valuations, and month-end closings with full integration to the general ledger (GL) is essential for accurate financial reporting.

Analysis

Performing analysis against deals and instruments, including credit risk, market risk, and portfolio analysis, is crucial for informed decision-making.

Integration with Cash and Liquidity Management

Integrating treasury and risk management with cash and liquidity management provides liquidity visibility and supports informed investing and borrowing decision-making.

Read More: How SAP S/4HANA Finance Makes Real Time Financial Close PossibleDeep Dive into SAP S/4HANA TRM Functionalities

SAP S/4HANA Treasury and Risk Management (TRM) empowers treasury teams with a comprehensive suite of functionalities designed to streamline operations, proactively manage risks, and make informed financial decisions. Let’s delve deeper into these functionalities to understand how TRM can transform your financial management:

Cash and Liquidity Management

The foundation of any sound financial strategy lies in a clear understanding of your cash flow. SAP S/4HANA TRM’s cash and liquidity management functionality provides a real-time, consolidated view of your cash positions across all subsidiaries and accounts, globally.

Global Cash Visibility

SAP S/4HANA TRM’s cash and liquidity management functionality means having a real-time consolidated view of your cash positions across subsidiaries and accounts, worldwide. This empowers you to make informed decisions regarding cash pooling, intercompany loans, and overall cash utilization. No more scrambling for information – you’ll have a holistic view of your cash flow at your fingertips.

Cash Flow Forecasting

Leverage advanced tools to create accurate cash flow forecasts based on historical data, planned transactions, and market trends. Predict potential shortfalls or surpluses well in advance and develop data-driven strategies to optimize your cash flow and avoid disruptions.

Liquidity Planning

Develop effective liquidity plans to ensure you have sufficient funds to meet upcoming obligations. Simulate various scenarios and make data-driven decisions to optimize your working capital. Never be caught off guard by unexpected cash flow demands.

Read more: How SAP S/4HANA Internal Orders Optimize Cost Management?

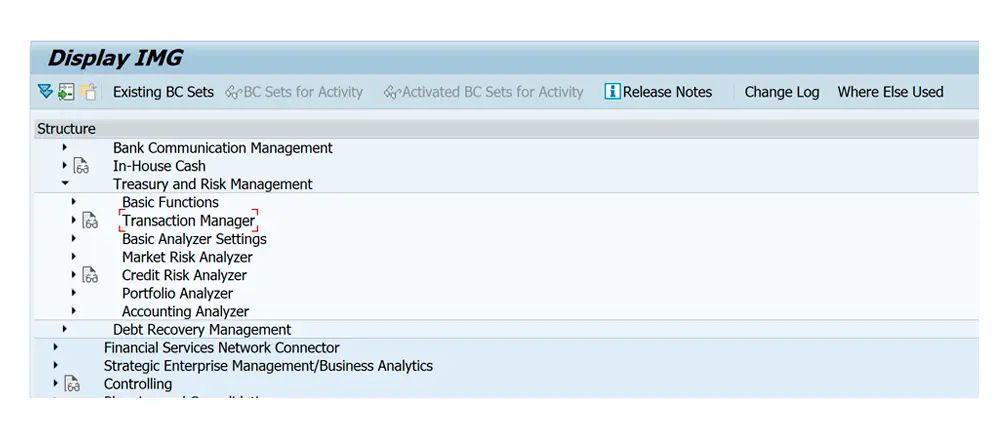

Transaction Manager

The Transaction Manager within SAP S/4HANA TRM offers a comprehensive suite of tools to manage the entire lifecycle of financial transactions, from initiation to accounting. It streamlines processes, enhances control, and facilitates informed decision-making. Key functionalities include:

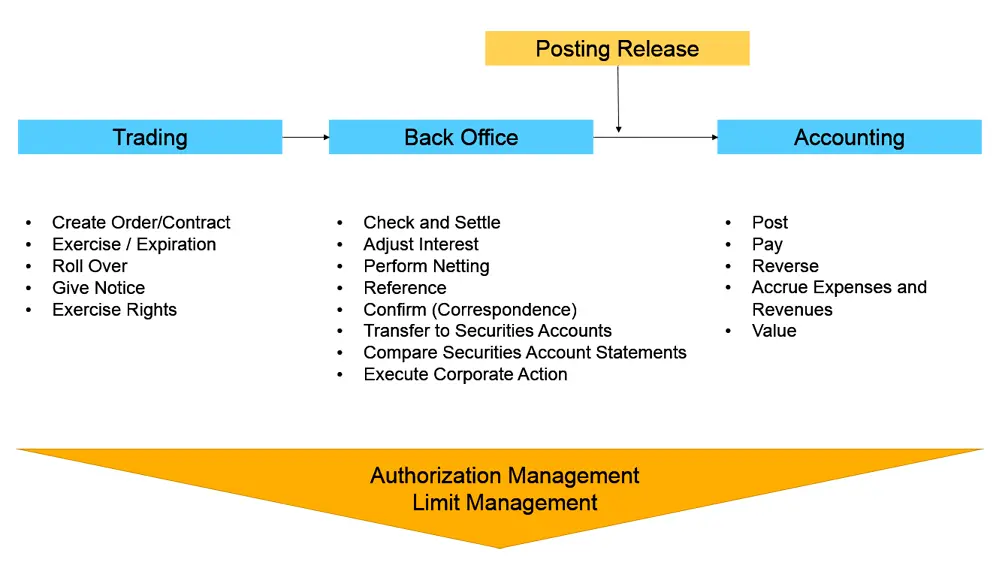

Transaction and Position Management

It helps manage financial transactions, positions, and their life cycles including trading, back office, and accounting. This provides a holistic view for informed decision-making.

Straight-Through Processing (STP)

This functionality automates transaction processing from initiation to accounting entries, improving efficiency and reducing errors.

Flexible Process Design

Transaction Manager allows customizing transaction and position management processes for different product types. This caters to specific needs while adhering to security measures.

Position Management

It provides a consolidated view of positions based on user-defined criteria. This is essential for effective portfolio management and risk assessment.

Trading

This area facilitates recording and evaluating financial transactions like entering and assessing bids, order limit checks, and price calculations.

Back Office

This supports managing account assignments, creating payment details, handling communication (confirmations), processing securities transfers, and handling corporate actions.

Accounting

This enables parallel position management for different accounting standards, automatic posting to general ledger, real-time updates, payment processing, valuations, accruals/deferrals, and transaction documentation.

Treasury Operations

Beyond the core functionalities of cash and liquidity management, SAP S/4HANA TRM offers a comprehensive set of tools to streamline your daily treasury operations.

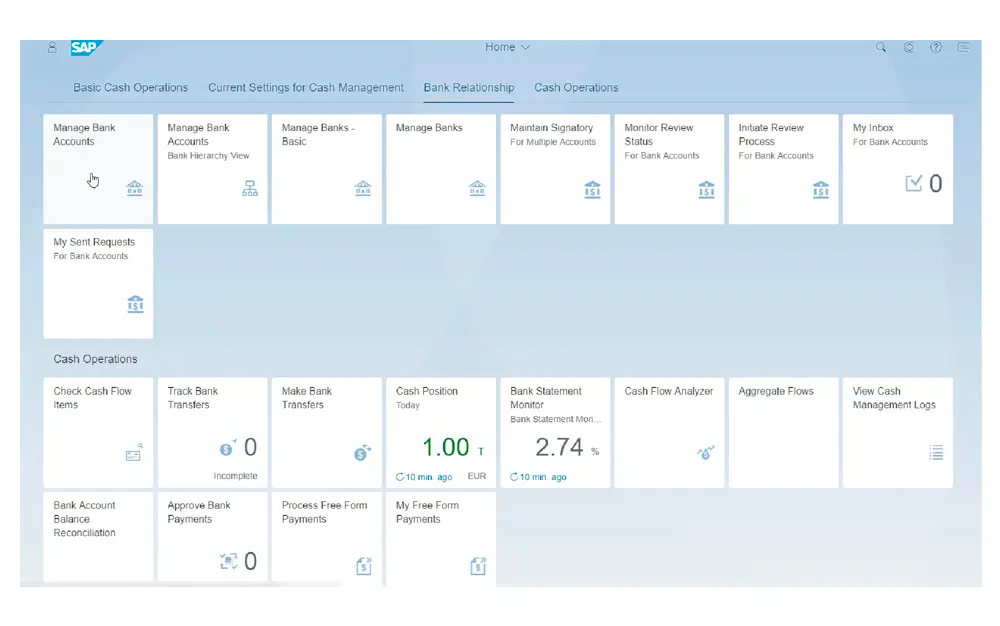

Centralized Bank Account Management

With the help of SAP S/4HANA bid adieu to managing multiple bank accounts across different platforms. TRM offers centralized management, reducing complexity and improving visibility. Automate bank statement reconciliations for increased efficiency and accuracy. Streamline your banking operations and free up your team’s time.

Automated Payment Processing

Streamline domestic and international payments with automated workflows and centralized approvals. Define rules for payment routing and leverage various payment methods for optimized processing. Eliminate manual tasks and errors, ensuring timely and efficient payments.

Investment Management

Manage your investment portfolio effectively with TRM. Monitor performance, ensure compliance with accounting standards, and make informed investment decisions based on real-time market data and risk analysis. Your investments are in good hands with centralized management and insightful data.

Debt Management

Efficiently manage debt issuance, repayment schedules, and interest calculations. Simulate various borrowing scenarios to determine the most cost-effective financing options. Make strategic debt decisions with the power of TRM’s functionalities.

Market Risk Analysis/Management

Market fluctuations can significantly impact your business. TRM equips you with the tools to proactively manage these risks–

Market Risk Analyzer

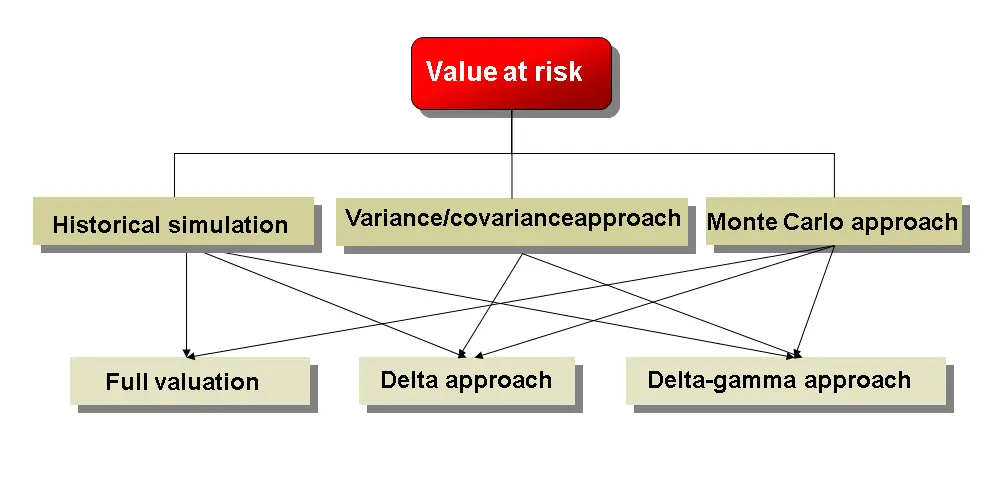

Identify, quantify, and manage market risks associated with foreign exchange fluctuations, interest rate movements, and commodity price changes. The Market Risk Analyzer equips you with a powerful toolkit for Value at Risk (VaR) calculations, sensitivity analysis, and scenario simulations. Proactively assess potential risks and develop effective mitigation strategies before market volatility impacts your business.

Hedge Management

Develop and implement effective hedging strategies to mitigate market risks. The system allows you to manage various hedging instruments like forwards, swaps, and options. Protect your business from unexpected market movements with strategic hedging practices.

Credit Risk Management

Mitigating the risk of defaults from counterparties is essential for financial stability. SAP S/4HANA TRM offers functionalities to achieve this

Credit Risk Analyzer

Minimize the risk of defaults by assessing the creditworthiness of potential and existing counterparties. Set credit limits based on risk analysis and monitor outstanding exposures. The Credit Risk Analyzer empowers you to identify potential problems and take proactive measures to safeguard your business from financial losses.

Credit Limit Management

Define credit limits for individual counterparties, groups, or specific instruments. This ensures you don’t exceed your risk tolerance and helps manage your exposure effectively. Control your credit risks with clear limits and monitoring.

Payment Processing

Reduce processing time and errors by automating repetitive payment tasks like approvals, routing, and execution.

Consolidate all your payment processing activities into a central “Payment Factory” for streamlined efficiency and enhanced control over your payments.

Bank Connectivity

The functionalities discussed so far empower treasury teams to manage various aspects of financial activities. But how does the data flow seamlessly between TRM and external systems, particularly banks? This is where bank connectivity comes into play. It acts as the critical backbone for efficient treasury operations by enabling:

Seamless Communication

Establish secure connections with your banks for real-time data exchange and automated transactions. Eliminate manual data entry and reduce the risk of errors associated with it. Ensure smooth information flow between your treasury systems and your banks.

SWIFT and SEPA Compliance

Ensure your payment processes comply with international standards like SWIFT (Society for Worldwide Interbank Financial Telecommunication) and SEPA (Single Euro Payments Area). Avoid delays and disruptions by adhering to international payment regulations.

Read more: What Is New Asset Accounting in SAP S/4HANA?Debt and Investment Management

This includes functionalities for managing instruments like money market placements, foreign exchange transactions, trade finance activities, securities portfolios, derivatives contracts, and hedging strategies.

Deal Capture and Processing:

Capture and process all your debt and investment transactions efficiently within the system. Ensure accurate record-keeping and simplified compliance with accounting standards. Maintain a complete and accurate record of your financial activities.

Portfolio Analysis and Reporting

Analyze the performance of your investment portfolio using various metrics like yield and risk-adjusted return. Generate comprehensive reports to gain insights into your investment strategies. Make data-driven investment decisions with the power of portfolio analysis and reporting functionalities within TRM.

By leveraging these functionalities, SAP S/4HANA TRM empowers treasury teams to streamline operations, proactively manage risks, and make informed financial decisions.

Benefits of SAP Treasury and Risk Management (TRM) on SAP S/4HANA for New Users

SAP Treasury and Risk Management (TRM) on SAP S/4HANA offers a powerful suite of tools designed to streamline your company’s financial operations, minimize risk, and maximize efficiency. Here’s a breakdown of some key advantages:

Real-time Visibility with In-Memory Computing

Unlike traditional systems that rely on fetching data from storage, S/4HANA leverages in-memory computing. This means critical financial information constantly resides in memory, allowing for instant analysis.

Moreover, Transaction Manager contributes to this benefit by providing real-time data on positions and transactions.

Enhanced Cash Flow Management

Forecasting cash flow accurately is crucial for any business. TRM on S/4HANA provides advanced tools to create realistic forecasts and liquidity plans. You can simulate various scenarios based on historical data, market trends, and planned transactions. This proactive approach helps you identify potential cash shortages or surpluses well in advance, allowing you to develop strategies to optimize your cash flow and avoid disruptions.

Streamlined Risk Mitigation

Foreign exchange fluctuations, interest rate movements, and other market factors can significantly impact your finances. TRM offers a comprehensive risk management toolkit.

The Market Risk Analyzer helps you identify and manage risks associated with foreign exchange (FX), interest rates, and commodities. It provides tools for Value at Risk (VaR) calculations, sensitivity analysis, and scenario simulations.

Similarly, the Credit Risk Analyzer allows you to assess the creditworthiness of counterparties (business partners) and set limits to mitigate potential defaults. By proactively managing these risks, you can protect your business from unexpected losses and ensure financial stability.

Increased Automation

TRM automates many time-consuming tasks, freeing up your team to focus on strategic initiatives. Imagine automating repetitive processes like payments, investments, and bank reconciliations. Also, SAP S/4HANA TRM’s Transaction Manager automates many tasks like trade capture, account assignment, and confirmations, leading to increased efficiency.

Improved Integration

TRM seamlessly integrates with other S/4HANA modules like Financial Accounting and Materials Management. This eliminates the need for manual data entry across different platforms and ensures consistency across your financial data. Additionally, it streamlines workflows and facilitates real-time data exchange between various departments, fostering better collaboration and informed decision-making.

Read more: What Is CO-PA? Simplifying Profitability Analysis With SAP S/4HANAMastering Your Financial Landscape with VC ERP Consulting

SAP S/4HANA TRM offers a comprehensive suite of functionalities designed to empower your treasury team and streamline your financial operations.

By leveraging functionalities like real-time cash flow visibility, automated risk management tools, and seamless integration with external systems, SAP S/4HANA TRM positions you to make informed decisions, mitigate risks, and optimize your financial performance.

VC ERP Consulting, a leading certified SAP Service & Implementation Partner, can help you navigate the entire process.

Our team of experienced SAP consultants possesses the expertise to guide you through every step, from initial assessment and solution design to implementation and ongoing support. We believe in providing best-practice solutions tailored to your specific needs, ensuring you maximize the value of your SAP investment.

Contact VC ERP Consulting today for a free consultation and discover how we can help you harness the power of SAP to transform your financial management.